The interest rate risk is a risk of incurring losses on the Bank's balance and off-balance sheet items sensitive to interest rate fluctuations, as a result of changes in the interest rates on the market.

The objective of interest rate risk management is to mitigate the risk of incurring losses arising from market interest rate changes to an acceptable level by shaping the structure of balance and off-balance sheet items.

50.1. Measurement of interest rate risk

In the process of interest rate risk management, the Group uses, in particularly, the Value at Risk (VaR) model, interest income sensitivity measure, stress tests and a repricing gap.

The value at risk (VaR) is defined as a potential loss arising from the maintained structure of balance and off-balance sheet items and the volatility of interest rates, with the assumed probability level and taking into account the correlation between the risk factors.

The sensitivity of interest income is a measure showing changes in interest income resulting from abrupt changes in the interest rates. This measure takes into account the diversity of revaluation dates of the individual interest-bearing items in each of the selected time horizons.

Stress-tests are used to estimate potential losses arising from a held structure of the statement of financial position and off-balance sheet items under market conditions that cannot be described in a standard manner using statistical measures. Two types of scenarios are used by the Bank:

- hypothetical scenarios – which are based on arbitrary interest rate fluctuations: a parallel move in interest rate curves for the particular currencies by ±50 b.p., ±100 b.p., ±200 b.p. and bend of yield curve scenarios (non-parallel fluctuations of peak and twist types),

- historical scenarios – in which interest rate fluctuations are adopted based on the behaviour of interest rates in the past, including: the highest historical change, a bend of a yield curve along with portfolio positions, the largest historical non-parallel fluctuation of the interest rate curves for securities and derivative instruments that hedge them.

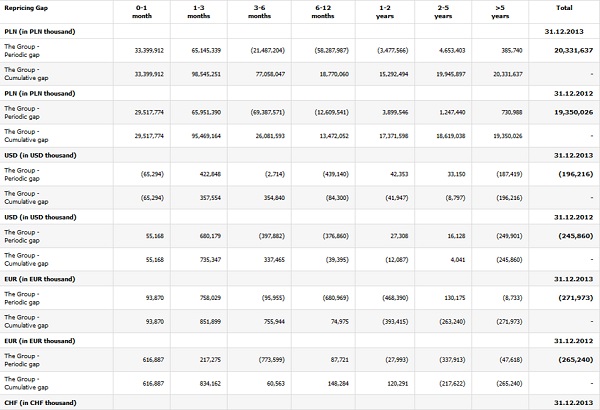

The repricing gap shows the difference between the present value of assets and liabilities exposed to interest rate risk, subject to revaluation in a given time range, and these balances are recognised on the transaction date.

At the end of 2013 and 2012 the Group had a positive cumulative gap in PLN in all time horizons.

50.2. Forecasting and monitoring of interest rate risk

As at 31 December 2013 and 31 December 2012, the exposure of the PKO Bank Polski SA Group to the interest rate risk comprised mainly of the exposure of the Bank. Interest rate risk generated by the Group entities with regard to PLN, EUR and CHF did not have a significant effect on the interest rate risk of the entire Group and therefore did not significantly affect its risk profile. Interest rate risk with regard to USD was significantly altered by exposure of the Group entities, in which the biggest part has the exposure of KREDOBANK SA.

VaR of the Bank and stress-tests analysis of the Group’s exposure to the interest rate risk are presented in the following table:

| Name of sensitivity measure | 31.12.2013 | 31.12.2012 |

|---|---|---|

| VaR for a 10-day time horizon with a confidence level of 99% threshold (in PLN thousand)* | 54,930 | 64,451 |

| Parallel movement of interest rate curves by 200 b.p. (in PLN thousand) (stress test)** | 495,858 | 270,818 |

* Due to the nature of the activities carried out by the other Group entities generating significant interest rate risk as well as a the specific nature of the market on which they operate, the Group does not calculate consolidated VaR. These companies apply their own risk measures in the interest rate risk management. KREDOBANK SA uses the 10-day interest rate VaR for the main currencies, which amounted to approx. PLN 10 686 thousand as at 31 December 2013 and PLN 14 287 thousand as at 31 December 2012, respectively.

** The table presents the value of the most adverse stress-test of the scenarios: movement of interest rate curves in PLN by 200 b.p. up and by 200 b.p. down.

As at 31 December 2013 the interest rate VaR for a 10-day time horizon (10-day VaR) amounted to PLN 54 930 thousand, which accounted for approximately 0.27% of the value of the Bank’s own funds. As at 31 December 2012, VaR for the Bank amounted to PLN 64 451 thousand, which accounted for approximately 0.33% of the Bank’s own funds*.

* Own funds calculated in accordance with regulations concerning calculation of the capital adequacy ratio.

50.3. Reporting of the interest rate risk

The Bank prepares daily, weekly, monthly and quarterly reports addressing interest rate risk. The quarterly reports are also applicable to the Group. Reports present the information on interest rate risk exposure and usages of available limits regarding the risk.

50.4. Management decisions as regards interest rate risk

The main tools used in interest rate risk management in the Group include:

- procedures for interest rate risk management,

- limits and thresholds for interest rate risk,

- defining allowable transactions based on interest rates.

The Group established limits and thresholds for interest rate risk comprising the following: price sensitivity, interest income sensitivity, limits and threshold for losses and limits on instruments sensitive to interest rate fluctuations.

Methods of interest rate risk management in the Group subsidiaries are defined by internal regulations implemented by those entities which are characterised by significant values of interest rate risk measure outcomes. These regulations are developed after consultation with the Bank and include recommendations issued by the Bank for Group entities.