The consolidated net profit of the PKO Bank Polski SA Group generated in 2013 amounted to PLN 3,229.8 million which was PLN 508.8 million lower than in 2012.

Net profit (in PLN million)

Result on business activities (in PLN million)

Income statement of the PKO Bank Polski SA Group (in PLN million)

| 2013 | 2012 restated | Change (in PLN million) | Change (in %) | |

|---|---|---|---|---|

| Interest and similar income | 10,763.5 | 13,198.2 | (2,434.7) | (18.4%) |

| Interest expense and similar charges | (4,041.5) | (5,109.0) | 1,067.4 | (20.9%) |

| Net interest income | 6,722.0 | 8,089.3 | (1,367.3) | (16.9%) |

| Fee and commission income | 3,926.6 | 3,648.2 | 278.4 | 7.6% |

| Fee and commission expense | (920.9) | (731.7) | (189.2) | 25.9% |

| Net fee and commission income | 3,005.8 | 2,916.5 | 89.2 | 3.1% |

| Dividend income | 5.8 | 8.1 | (2.3) | (28.6%) |

| Net income from financial instruments measured at fair value | 54.3 | 94.2 | (39.9) | (42.3%) |

| Gains less losses from investment securities | 67.5 | 79.8 | (12.3) | (15.4%) |

| Net foreign exchange gains | 241.8 | 256.1 | (14.3) | (5.6%) |

| Net other operating income and expense | 609.7 | 177.7 | 432.1 | 3.4x |

| Net impairment allowance and write-downs | (2,037.9) | (2,325.2) | 287.3 | (12.4%) |

| Administrative expenses | (4,622.5) | (4,682.5) | 60.0 | (1.3%) |

| Operating profit | 4,046.4 | 4,613.9 | (567.5) | (12.3%) |

| Share of profit (loss) of associates and jointly controlled entities | (2.0) | 19.0 | (21.0) | x |

| Profit (loss) before income tax | 4,044.5 | 4,632.9 | (588.5) | (12.7%) |

| Income tax expense | (816.3) | (895.5) | 79.2 | (8.8%) |

| Net profit (including non-controlling shareholders) | 3,228.2 | 3,737.5 | (509.3) | (13.6%) |

| Profit (loss) attributable to non-controlling shareholders | (1.6) | (1.2) | (0.4) | 35.8% |

| Net profit (loss) | 3,229.8 | 3,738.6 | (508.8) | (13.6%) |

In the PKO Bank Polski SA Group’s income statement for the year 2013, the sum of revenue positions amounted to PLN 10 706.9 million and was PLN 914.8 million, i.e. by 7.9% lower than in 2012, mainly due to decrease of net interest income by 16.9% y/y, partially compensated by higher net result from other operating income and expense.

Net interest income

The net interest income generated in 2013 was PLN 1,367.3 million lower than in the previous year, mainly due to a decrease in interest income by PLN 2 434.7 million, determined by the fall in market interest rates, which for WIBOR 1M and 3M on an annual basis was 1.60 pp. and 1.40 pp. respectively along with a decrease in interest expense by PLN 1,067.4 million.

The structure of interest income (in PLN million)

The structure of interest expense (in PLN million)

In 2013, interest income amounted to PLN 10 763.5 million and in comparison with 2012 was lower by 18.4%, mainly as a result of a decrease in:

- income in respect of loans and advances to customers (- PLN 1 519.8 million y/y) – the effect of lower interest rates on loans as a result of revaluation of the portfolio due to the fall in market interest rates, partially compensated by increase of loans and advances to customers portfolio volume by PLN 6.1 billion y/y,

- income from derivative hedging instruments (PLN - 416.2 million y/y), resulting from narrowing the spread between the PLN and foreign currency rates as a result of the drop in the WIBOR market rates and the drop in the average volume of CIRS transactions,

- income from securities (PLN -411.1 million y/y) mainly as a result of a drop in average interest rates and the change of portfolio structure.

In 2013, interest expense amounted to PLN 4 041.5 million and was 20.9% lower than in 2012 mainly due to a drop in the costs of amounts due to customers of PLN 1 147.9 million y/y. The drop in the costs of amounts due to customers resulted from lower average interest rate on deposits – the effect of the drop in market interest rates and the adaptation of the price offer of deposit products. The change in the structure of deposits – an increase in the share of current deposits – also had a positive effect on the level of the interest expense on amounts due to customers.

In 2013, the average interest rate on loans in PKO Bank Polski SA amounted to 6.1%, whereas the average interest rate on deposits in total amounted to 2.4%, as compared with 7.4% and 3.1% in 2012 respectively.

In 2013, the PKO Bank Polski SA Group’s margin amounted to 3.7%, which represents a drop of 1.0 pp. y/y, mainly as a result of the decrease in net interest income. The drop in the net interest income is due to the drop in market interest rates which is the direct reason why the drop in interest rates on assets based mostly on market rates is faster than the drop in interest rates on the deposit offer, accompanied by an increase in the average volume of average interest-bearing assets (mainly the portfolio of loans and advances to customers).

Moreover, in 2013, the Group changed accounting policies on recognition of income and expenses related to sale of insurance products, which resulted in an increase in net interest income for the year 2012 presented earlier by PLN 206.5 million. Detailed information on the changes in accounting policies was described in Note 2 of the Consolidated Financial Statements of the PKO Bank Polski SA Group for the year 2013.

Interest income and expense of the PKO Bank Polski SA Group (in PLN million)

| 2013 | Structure 2013 | 2012 restated | Structure 2012 | Change 2013/2012 | |

|---|---|---|---|---|---|

| Interest income, of which: | 10,763.5 | 100.0% | 13,198.2 | 100.0% | (18.4%) |

| Loans and advances to customers | 9,065.5 | 84.2% | 10,585.4 | 80.2% | (14.4%) |

| Securities | 1,074.5 | 10.0% | 1,485.6 | 11.3% | (27.7%) |

| Derivative hedging instruments | 454.3 | 4.2% | 870.5 | 6.6% | (47.8%) |

| Placements with banks | 165.2 | 1.5% | 250.2 | 1.9% | (34.0%) |

| Other | 4.0 | 0.0% | 6.6 | 0.0% | (39.1%) |

| Interest expense, of which: | (4,041.5) | 100.0% | (5,109.0) | 100.0% | (20.9%) |

| Amounts due to customers | (3,489.8) | 86.3% | (4,637.7) | 90.8% | (24.8%) |

| Debt securities in issue | (472.6) | 11.7% | (431.0) | 8.4% | 9.6% |

| Deposits from banks | (17.1) | 0.4% | (27.2) | 0.5% | (37.1%) |

| Premium on debt securitiesavailable for sale | (38.7) | 1.0% | (9.9) | 0.2% | 3.9x |

| Other expense | (23.3) | 0.6% | (3.1) | 0.1% | 7.5x |

| Net interest income | 6,722.0 | x | 8,089.3 | x | (16.9%) |

Net fee and commission income

Net fee and commission income generated in 2013 amounted to PLN 3 005.8 million and was PLN 89.2 million higher than in the previous year, as a result of PLN 278.4 million increase in commission income, accompanied by higher commission expenses of PLN 189.2 million.

Structure of commission income (in PLN million)

The structure of commission expense (in PLN million)

The level of net fee and commission income was significantly determined by an increase in:

- commission income in respect of maintenance of investment funds and Open Pension Funds (including management fees) by PLN 77.1 million y/y, due to more profitable sales structure of funds, and more than 40% increase in the value of managed assets, determined by economic upturn and acquisition of the OFE Polsat’s assets at the beginning of the second quarter of 2013,

- net commission income in respect of loan insurance (+PLN 21.8 million y/y) due to the increase in insurance saturation of loans, additionally supported by an increase in sale of loans,

- commission income in respect of maintaining of bank accounts (+PLN 13.2 million y/y),

accompanied by a decrease in:

- the result on payment cards (-PLN 27.7 million y/y), mainly due to a decrease in the interchange fee, in connection with a reduction of IF rates by Visa and Mastercard from the beginning of the year - lower commission related to IF was accompanied by the increase in card transactions,

- commission income in respect of performing the function of the Treasury bonds issue agent (-PLN 10.3 million y/y) and

- commission income in respect of cash transactions (-PLN 9.7 million y/y), due to development of electronic banking services.

Moreover, in 2013, the Group changed accounting policies on recognition of income and expenses related to sale of insurance products, which resulted in a decrease of previously presented net fee and commission income for the year 2012 by PLN 154.7 million. Detailed information on the changes in accounting policies was described in Note 2 of the Consolidated Financial Statements of the PKO Bank Polski SA Group for the year 2013.

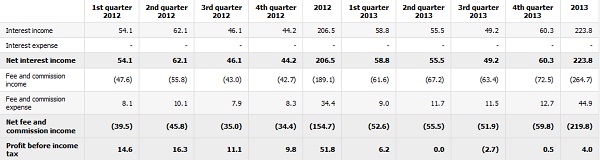

The impact of changes in accounting policies described above on the Bank’s results on a quarterly basis is presented in the table below:

Fee and commission income and expense of the PKO Bank Polski SA Group (in PLN million)

| 2013 | Structure 2013 | 2012 restated | Structure 2012 | Change 2013/2012 | |

|---|---|---|---|---|---|

| Fee and commission income, of which: | 3,926.6 | 100.0% | 3,648.2 | 100.0% | 7.6% |

| Payment cards | 1,314.3 | 33.5% | 1,186.7 | 32.5% | 10.8% |

| Maintenance of bank accounts | 894.5 | 22.8% | 881.3 | 24.2% | 1.5% |

| Loans and advances granted | 585.5 | 14.9% | 578.5 | 15.9% | 1.2% |

| Loan insurance | 266.2 | 6.8% | 226.3 | 6.2% | 17.7% |

| Maintenance of investment and open pension funds(including management fees) | 400.4 | 10.2% | 323.3 | 8.9% | 23.9% |

| Cash transactions | 126.8 | 3.2% | 136.5 | 3.7% | (7.1%) |

| Securities transactions | 79.3 | 2.0% | 82.9 | 2.3% | (4.2%) |

| Servicing foreign mass transactions | 52.3 | 1.3% | 48.8 | 1.3% | 7.2% |

| Performing the function of the Treasury bonds issue agent | 29.0 | 0.7% | 39.3 | 1.1% | (26.1%) |

| Sale and distribution of court fee stamps | 20.9 | 0.5% | 25.6 | 0.7% | (18.3%) |

| Fiduciary services | 4.3 | 0.1% | 3.7 | 0.1% | 17.4% |

| Other* | 153.0 | 3.9% | 115.4 | 3.2% | 32.5% |

| Commissions expense, of which: | (920.9) | 100.0% | (731.7) | 100.0% | 25.9% |

| Payment cards | (575.6) | 62.5% | (420.3) | 57.4% | 37.0% |

| Loan insurance | (95.0) | 10.3% | (76.9) | 10.5% | 23.5% |

| Acquisition services | (101.7) | 11.0% | (107.1) | 14.6% | (5.1%) |

| Settlement services | (24.4) | 2.6% | (24.1) | 3.3% | 1.4% |

| Operating services provided by banks | (11.5) | 1.2% | (10.8) | 1.5% | 6.8% |

| Assets management | (12.6) | 1.4% | (10.0) | 1.4% | 26.7% |

| Other** | (100.1) | 10.9% | (82.6) | 11.3% | 21.2% |

| Net fee and commission income | 3,005.8 | x | 2,916.5 | x | 3.1% |

* Included in ‘Other’ are i.a. commissions of the Brokerage House for servicing Initial Public Offering issue and commissions for servicing indebtedness of borrowers against the State budget.

** Included in ‘Other’ are i.a.: fees and expenses paid by the Brokerage House to WSE and the National Depository for Securities (KDPW).

Administrative expenses

In 2013, administrative expenses amounted to PLN 4 622.5 million and decreased by 1.3% as compared with the previous year.

The structure of administrative expenses (in PLN million)

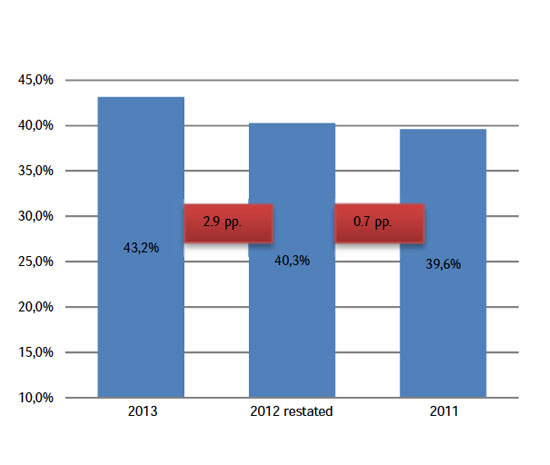

C/I

The level of administrative expenses was mainly determined by:

- decrease in employee benefits by PLN 57.4 million y/y,

- decrease in overheads and other expense by PLN 40.5 million y/y, i.a. as a result of a decrease in costs of maintenance and rental of non-current assets , the costs of promotion and advertising and the costs of PFSA, with an increase in the BGF expenses – mainly due to the implementation of prudential fee,

- increase in amortisation and depreciation by PLN 38.0 million y/y – mainly as a result of increase in amortisation of intangible assets.

Moreover, in 2013, the Group changed accounting policies with regard to the presentation of actuarial gains and losses, which resulted in an increase in employee benefits for the year 2012 presented earlier by PLN 64.1 million. Detailed information on the changes in accounting policies was described in Note 2 of the Consolidated Financial Statements of the PKO Bank Polski SA Group for the year 2013.

Administrative expenses of the PKO Bank Polski SA Group (in PLN million)

| 2013 | Structure2013 | 2012restated | Structure 2012 | Change 2013/2012 | |

|---|---|---|---|---|---|

| Employee benefits | (2,514.8) | 54.4% | (2,572.2) | 54.9% | (2.2%) |

| Overheads and other, of which: | (1,528.5) | 33.1% | (1,569.1) | 33.5% | (2.6%) |

| Contribution and payments to the Bank Guarantee Fund | (167.7) | 3.6% | (144.0) | 3.1% | 16.5% |

| Amortisation and depreciation | (579.2) | 12.5% | (541.3) | 11.6% | 7.0% |

| Total | (4,622.5) | 100.0% | (4,682.5) | 100.0% | (1.3%) |

The effective control of incurred administrative expenses resulted in maintaining high operating efficiency of the PKO Bank Polski SA Group, measured with the C/I ratio, which amounted to 43.2% as at the end of 2013, i.e. well below the average in the banking sector.

Net impairment allowance and write-downs

Net impairment allowance and write-downs reflects a conservative approach of the PKO Bank Polski SA Group to recognition and measurement of credit risk. Improvement of net impairment allowance (-12.4% y/y) is mainly the result of a decrease in the net impairment allowance on the consumer and housing loans portfolio as a result of improvement of the quality of newly granted loans compared to the older generations.

As at the end of 2013, the share of impaired loans and the coverage ratio of impaired loans respectively amounted to 8.2% (a decrease by 0.7 pp. in comparison to 2012) and 51.7% (an increase by 1.2 pp. in comparison to 2012), due to improvement of the quality of consumer loans.

The cost of risk at the end of 2013 amounted to 1.3% compared to 1.4% as at the end of 2012, as a result of the improvement of the net impairment allowance on the consumer and housing loans portfolio.

Net impairment allowance of the PKO Bank Polski SA Group (in PLN million)

| 2013 | Structure 2013 | 2012 | Structure 2012 | Change 2013/2012 | |

|---|---|---|---|---|---|

| Net impairment allowance, of which: | |||||

| investment securities available for sale | (16.2) | 0.8% | (13.5) | 0.6% | 19.6% |

| loans and advances to customers measured at amortised cost | (2,028.3) | 99.5% | (2,138.5) | 92.0% | (5.2%) |

| non-financial sector | (2,015.4) | 98.9% | (2,117.9) | 91.1% | (4.8%) |

| consumer loans | (412.5) | 20.2% | (568.8) | 24.5% | (27.5%) |

| housing loans | (269.4) | 13.2% | (460.0) | 19.8% | (41.4%) |

| corporate loans | (1,308.3) | 64.2% | (1,087.3) | 46.8% | 20.3% |

| debt securities | (25.3) | 1.2% | (1.8) | 0.1% | 14x |

| financial sector | (8.1) | 0.4% | 5.5 | (0.2%) | x |

| public sector | 10.7 | (0.5%) | (5.6) | 0.2% | x |

| finance lease receivables | (15.5) | 0.8% | (20.4) | 0.9% | (24.0%) |

| intangible assets | (11.0) | 0.5% | (11.3) | 0.5% | (2.8%) |

| investments in associates and jointly controlled entities | (3.3) | 0.2% | (24.3) | 1.0% | (86.4%) |

| tangible fixed assets | (0.5) | 0.0% | (11.8) | 0.5% | (96.1%) |

| other | 21.4 | (1.1%) | (125.8) | 5.4% | x |

| Total | (2,037.9) | 100.0% | (2,325.2) | 100.0% | (12.4%) |